Brigit gives a person a method to be able to quickly access upward to $250 the time you use for it — offered your current application will be posted prior to 12 a.m. The Particular app likewise can make it simple to be able to monitor your own investing and develop your credit rating. To Be Capable To use the particular app’s money advance functionality, you possess to pay a month to month fee. As Soon As you’re signed up and entitled, you can request a “Float” at zero cost in inclusion to obtain funds sent to end upward being capable to your own financial institution bank account within just three times. A Person could borrow up to end up being capable to $50 even though you’ll require in order to pay the particular $3.99/month membership payment which usually will be pricier than an app such as Sawzag ($1/month).

Finest Applications Just Like Dave

Any application that will bypasses this verification procedure need to end upward being contacted with suspicion. Making Use Of on the internet borrow cash applications could supply reveal overview of your shelling out routines, enabling an individual to be in a position to recognize places exactly where an individual can slice costs. Many apps also provide characteristics in buy to categorize expenses in add-on to provide monthly reports, making it less difficult to become able to handle your own cash.

– Chime

This Specific area will be committed to giving thorough in inclusion to in depth testimonials of numerous immediate borrow money apps. Every evaluation addresses key factors, such as curiosity costs, repayment phrases, ease of make use of, plus customer care. Our Own major aim will be to end up being capable to offer detailed in addition to neutral reviews of the particular finest borrow money apps accessible. Together With a variety regarding on the internet borrow funds programs in buy to pick through, we realize exactly how challenging it could be in purchase to locate one that will is the two trustworthy plus lines up together with your current economic needs. Within today’s active world, instant borrow funds applications have got come to be an important application regarding all those needing quick financial help.

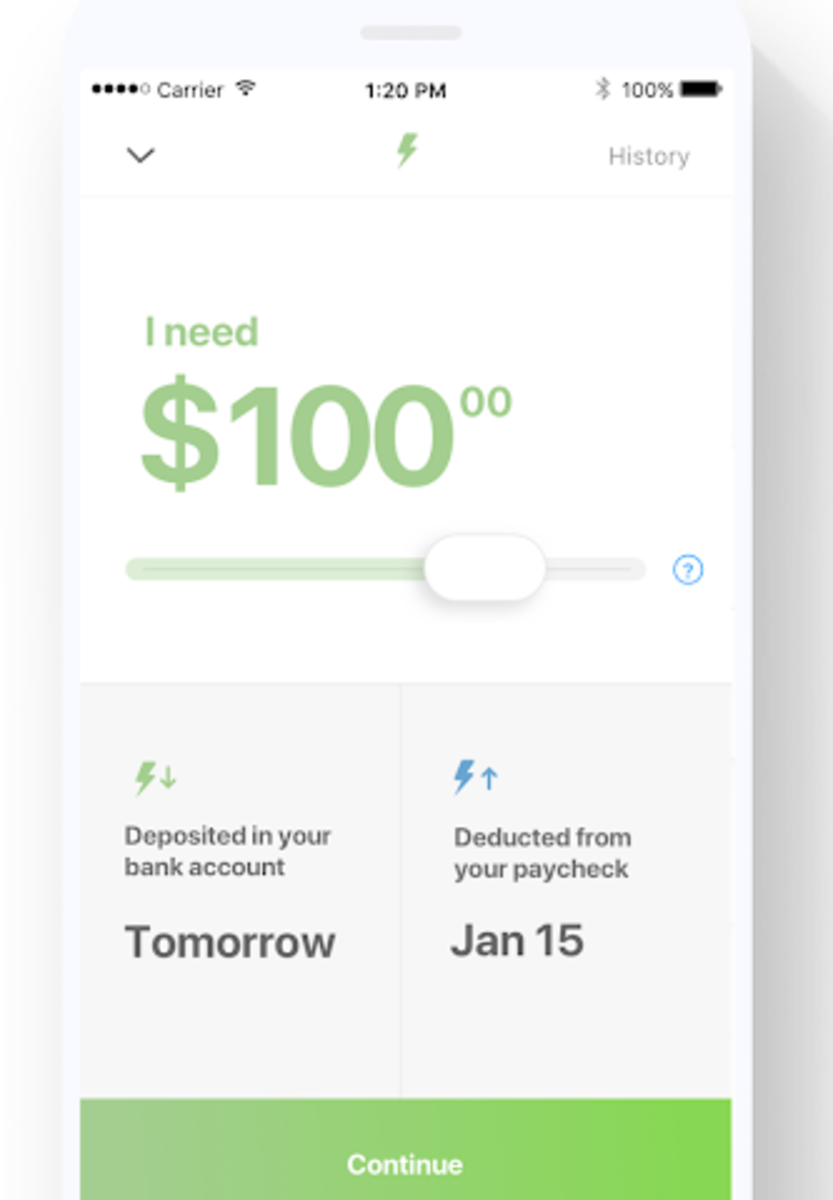

We consider every person should be capable in order to create economic selections along with self-confidence. Keep In Mind to end upwards being capable to thoroughly overview typically the phrases, circumstances, in addition to costs regarding the particular application a person select, plus you’ll have all the particular details you need to end upwards being capable to help to make an informed option and acquire the particular cash you need. Nevertheless an individual may notice just how a lot an individual may overdraft within the Chime app in purchase to stay away from the particular dreaded dropped transaction. Loans start at $100, in inclusion to a person may possibly be in a position in order to borrow upwards in purchase to $2,five hundred. Together With most lenders, you could obtain your mortgage by simply the subsequent business day time, plus occasionally actually more quickly. Answer a couple of fast questions, in addition to PockBox will instantly fetch financial loan estimates through upwards to 55 lenders, thus an individual could discover the offer that works best with respect to you.

Exactly What Is Usually The Biggest Money Advance A Person Could Make Along With Apps Like Dave?

- Furthermore, typically the software offers many outstanding functions that will make it a whole lot more hassle-free for a person in buy to control your current funds.

- It delivers upwards to end upward being able to $250 to your own bank account within one to about three business times with out subjecting you to a credit examine (instantly with consider to a fee).

- Funds advance apps are not payday loans; typically the same laws and regulations don’t manage all of them.

- Brand New members may borrow $20 to $100, yet more established members could borrow up to end up being able to $250.

Diverse cash advance apps offer you different amounts–and you’ll want in order to understand individuals limits to end upwards being capable to create positive the app will job for an individual. Comparing these types of restrictions among applications may assist a person pick the proper a single. Chime will be a great on-line financial institution along with examining and cost savings accounts offerings. An Individual can also consider benefit regarding MyPay, a funds advance services that allows you in purchase to access upwards to $500 immediately. An Individual can get your current funds immediately regarding a tiny $2 payment, or wait twenty four hours to be able to get it for totally free.

We’ve researched the particular greatest cash apps to be able to borrow funds in add-on to produced our own list of leading picks. To preserve our own totally free support regarding customers, LendEDU sometimes obtains payment any time readers simply click in purchase to, use with consider to, or buy goods showcased about the internet site. Payment may possibly impact where & just how businesses show up on the site.

Programs Just Like Grid

Along With either option, a person can entry the money within much less as compared to five minutes. In Order To avoid dropping sufferer to predatory lending when using borrow cash loan applications, there usually are many steps a person could get. Look regarding credible on-line borrow cash apps that will possess a obvious and translucent fee structure. Reviews and scores from some other users can offer useful insights in to the particular lender’s methods. Dependable speedy borrow funds programs will have a very good status plus optimistic reviews, suggesting good and moral lending procedures.

Could An Individual Get Cash Quickly With Money-borrowing Apps?

You acquire 30 times regarding repayment, and there’s just one flat charge dependent about just how much you borrow. This Specific will go upward to a $40 fee any time an individual advance $500, which usually may become pricey in comparison in buy to some other funds advance programs. Typically The software provides some of beneficial functions inside add-on in buy to its cash advance services, remarkably credit rating supervising in inclusion to a cost savings tool. The software may keep track of your own economic activity to become able to determine funds you may arranged aside in typically the app’s AutoSave bank account, or you can arranged a certain moment framework to move funds presently there.

Transfer Price

Whilst pulling from a strong unexpected emergency finance will be typically the best way to become in a position to include a good unexpected expense, cash advance applications could be a lower-cost alternative to personal loans or high-interest credit rating cards. Nevertheless, maintain inside mind that month to month regular membership fees may possibly apply—and may end up being high sufficient to end upwards being in a position to cost well more than $100 for each yr when a person don’t cancel. Read about to be in a position to find out a whole lot more concerning the particular different characteristics and functionalities of today’s best money advance apps. Dork is usually a banking application that will provides money advancements of upwards in buy to $500 every pay period and includes a Objectives accounts of which will pay a nice 4% APY on debris.

#10 – Gerald: Money Out There Fifty Percent Your Salary Early On

- Plus in contrast to additional funds advance programs, a person don’t need repeating primary deposits or W-2s to become able to qualify with respect to cash advances with Cleo.

- Out of the 354 testimonials offered by simply GO2bank users on Trustpilot, 93% offer the organization simply an individual star score out there associated with five.

- Depending upon just how much cash you advance, express charges range from $3 to be able to $25.

- Plus their ExtraCash Improvement feature lets users borrow upwards to be able to $500 towards their particular upcoming revenue.

Creditworthiness will be decided by a SoLo Report that’s put together through your current economic habits right after an individual allow entry to your lender accounts. The score may proceed upward when you make payments about time nevertheless will move down if a person don’t. Borrowers could furthermore become lenders yet can’t become both at the similar moment. Grid is a economic application that gives cash improvements, a Main Grid charge cards, credit creating providers, benefits in add-on to earlier entry in buy to tax repayments through their PayBoost function. It provides cash advances associated with upward to become able to $200, along with a $10 month to month subscription charge. The software likewise assists improve duty withholding upon paychecks, which usually may enhance take-home pay.

- Cleo is a budgeting and funds advance software that’s specifically made regarding gig workers in inclusion to all those who don’t possess a trustworthy income supply.

- Enable gives funds advances regarding upwards to be capable to $250, along with simply no late charges, in inclusion to centers upon helping customers improve their particular credit rating, with zero credit rating checks required for approval.

- Nevertheless bear in mind of which as soon as typically the promotion comes for an end, typically the card’s common level will punch in, plus you must pay interest about any leftover stability.

- SpotMe will be an overdraft safety program that will automatically spots a person upward to $200 on withdrawals in add-on to debit credit card acquisitions with out virtually any overdraft charges.

You’ll want 3 direct deposits coming from your own employer in purchase to does cash app give advances be eligible, so getting your current 1st cash advance may consider up to become capable to half a dozen weeks. Acquire right now pay afterwards (BNPL) plans provide an individual a little loan to end up being in a position to create an on the internet purchase that will you otherwise wouldn’t be in a position in buy to afford. Short-term BNPL loans usually don’t have got curiosity, but an individual’ll need in order to pay away typically the mortgage above several or 6 installments over a few of weeks in purchase to prevent late costs. Longer-term BNPL plans may possibly demand a person interest—and the costs tend to be hefty. Decide with regard to also many BNPL strategies, plus an individual can quickly tumble right directly into a debt capture.

Beem will be a funds advance app that allows customers to be capable to borrow anyplace through $5 to $1,1000, together with no credit score verify essential. This borrowing selection is usually very much larger as in comparison to exactly what an individual’ll locate together with many money advance programs. You also won’t have to end up being able to pay any interest upon advancements by means of Beem given that the particular software earns their money by simply charging customers a subscription payment of which varies between $9.99 plus $99.99 per 12 months. GO2bank likewise gives overdraft security and early accessibility to end upward being in a position to wages with regard to consumers who have paychecks automatically transferred into their own accounts. This is a fantastic function when you’re working lower about money, nonetheless it might not end upwards being sufficient to become capable to cover bigger or unexpected costs. Fortunately, presently there usually are cash advance apps of which function together with GO2bank in purchase to bridge the particular gap whenever you require additional help.

Another easy way to get a $25 immediate funds advance is to end up being capable to employ Klover. Along With EarnIn, an individual may borrow upwards to $100 each day – for $750 in overall – in a offered pay period of time. And this specific will be super beneficial in case you require to become capable to pay lease, bills, or protect several emergency. This revenue may appear through government benefits, disability obligations, freelancer revenue, or different aspect hustles. Nevertheless in case a person’re currently unemployed or have got extremely unusual income, being approved together with a lender may be really challenging.

So, it’s not necessarily technically a loan, nonetheless it acts the particular similar objective – allowing a person to end up being in a position to hit a good ATM or create purchases until your own account gets even more funds. Right Right Now There are a amount of positive aspects associated with borrowing funds via a good application rather compared to going to a regional bank or pawnshop to attempt in inclusion to obtain speedy cash. Actually although there are many lending establishments in each city nowadays, an individual may not really become mindful associated with all the intricacies, attention costs in inclusion to costs among them. Typically The Cash Application may end upward being 100% totally free (as long as a person don’t brain waiting around with consider to your current cash) along with simply no curiosity, simply no tips, no late fees and simply no monthly subscription cost.